30+ Buying a house with bad credit

Traditional fixed-rate home loan. Ad Your Home Should Be A Place You Love.

Home Buying Tips For Your 20s 30s And 40s Real Estate 101 Trulia Blog

Use Our Comparison Site Now.

. Contents10 richest neighborhoodsBad credit qualifyCinema south lamar. Ad Get Preapproved Compare Loans Calculate Payments - All Online. If you have a poor credit rating in the first instance then you are unlikely to get access to the best rates.

If you have a credit score over 580 you can get an FHA loan if you can make a down payment of 35 of the total value of the home. The caveat with these types of loans is that while they are insured by the government and can set. Mortgages and bank statement loans for self.

Apply for an FHA loan. In as few as 30 days youll start to see. Mortgage options if your spouse has bad credit.

Lock In Your Rate With Award-Winning Quicken Loans. Explore the Lowest Rates Online. Visit One Of Our Home Centers To Customize.

A credit score of 740 or above is considered excellent credit. Ad HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Although there are three credit bureaus TransUnion Experian and Equifax that classify good and bad scores in different ranges generally anything below 600 is considered.

Ad Dont Let Bad Credit Score Stop You. Compare The Best Mortgage Lenders For Your Needs. So for example lets assume the house you picked is worth 200000 but you put down a 30000 down payment.

FHA loans let you put down as little as 35 if you have a credit score of 580 or higher. Loans insured by the Federal Housing Administration better known as FHA loans come with lower credit requirements. Steps To Buying A House For First-Time Homebuyers With Bad Credit is possible with the help of an experienced loan officer.

Pay your bills on time every time. Some mortgage options cater to. Ad Dont Let Bad Credit Score Stop You.

Pick Your Rate Save. Ad Compare the 5 Best Home Loan Lenders of 2022. Compare The Best Mortgage Lenders For Your Needs.

Sleek New Designs Innovative Energy Efficient Features. Buy HUD Homes and Save Up to 50. Let Us Help You Find A Home.

JenniferAccept bad creditThe first time out without me he made an offer on the original house. Ad Compare 2022s Best Bad Credit Loans to Enjoy the Best Rates in the Market. Find a Home Loan Lender Offer That Suits You.

Looking for the Best Bad Credit Loan. Adjustable rate mortgage ARM Above 600. Budget for a higher interest rate and monthly payments.

Typically the minimum credit score requirement for buying a house is between 500-620 depending on the type of loan. Buying a House with Bad Credit. These loans can approve a borrower with a credit score as low as 500.

Northpoint Real Estate 09302021. Register for 1 to See All Listings Online. If individuals cant get approved for conventional mortgages then FHA loans are the remaining option for hopeful homebuyers with bad credit.

For those with a credit score of 580 or higher the minimum down payment is just 35 percent compared to the standard 20 percent for traditional loans. FHA loans may allow lower credit scores in the 500. In most cases youll be.

Most conventional lenders require a credit score of at least 620 to qualify for a mortgage. If you have a credit score of 500-579 you must put. Some people are under the mistaken impression that you must have good or even great credit in order to buy a house.

To get the LTV ratio you divide the 170000 loan by the 200000 home value. He would have a. For a 100000 house thats 3500.

Another terrific way to improve your credit score is to make on-time payments to your creditors. FHA loan requirements are. If your credit is in the.

An FHA loan is likely your best bet for buying a house with bad credit. FHA loans are mortgages guaranteed by the Federal Housing Administration and are great. Unfortunately homeowners with lower credit tend to pay more for their home loans.

Buying a house when one spouse has bad credit is still possible with the right mortgage. However you may still be able to get a loan with a credit score of at least 500.

How To Buy A Second Home With No Down Payment Clever Girl Finance

First Time Home Buyers Guide What Is An Fha Mortgage First Time Home Buyers Home Mortgage Home Loans

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Spreadsheet Template

What Makes Your Credit Score Go Up And Down

What I Wish I Had I Known Before Buying An Old Home

Buying Selling Houses Blog Posts Biggerpockets First Time Home Buyers Home Buying Property Values

8 Tips For Buying A House With Bad Credit Clever Girl Finance

First Time Homebuyers Are Getting Outbid By Big Companies R Losangeles

The Pros And Cons Of Buying A House Vs Building A House Peplifestyle Real Estate

Old Vs New Homes Which Should I Buy Bankrate

30 Awesome Free Facebook Cover Backgrounds Green Nature Wallpaper Beautiful Nature Wallpaper Nature Wallpaper

When Buying A House In The Usa Is It Normal For The Real Estate Agent To Ask For Your Income Tax Returns And Paystubs Quora

Can I Afford My First House Making 18 50 An Hour I M Not Talking About An Extremely Big Home But More Like A Starter Home Quora

Buying A Home With Bad Credit In Grand Rapids Mi Michigan Bad Credit Mortgage Loans

Jolayne Craig At Atlantic Coast Mortgage Home Facebook

Why I Quit Buying Rental Properties To Buy Reits Instead Seeking Alpha

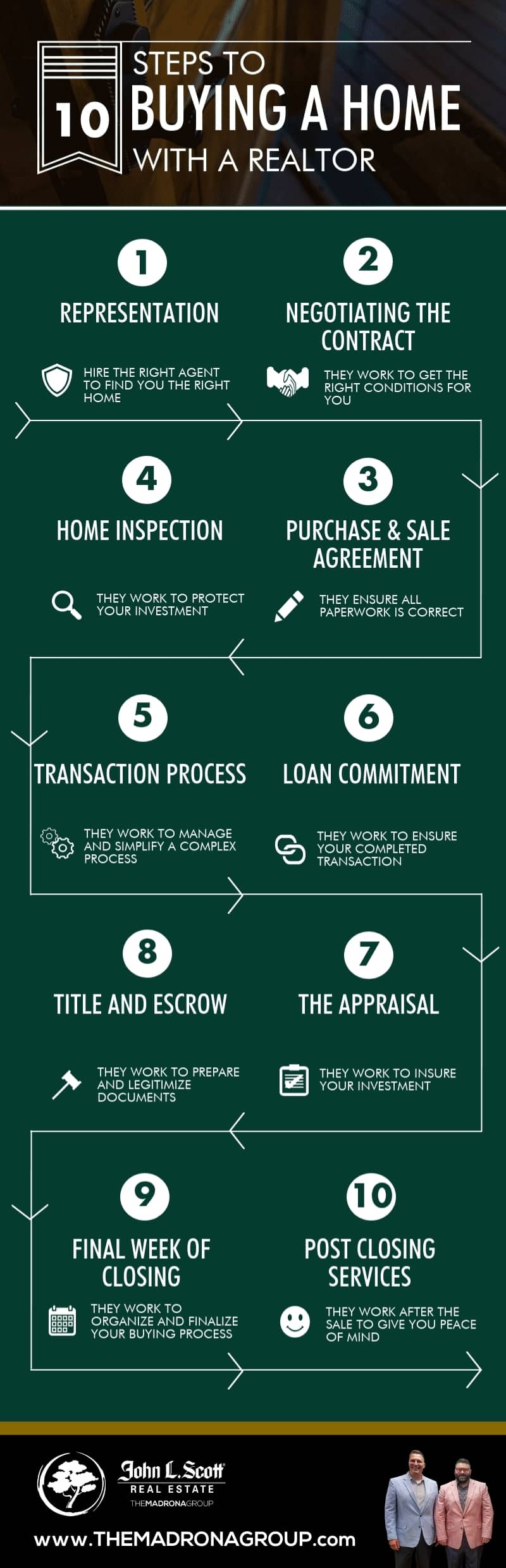

Critical Steps To Buying A House In Washington State